Form W-2 – Employer Responsibilities and Employee Taxation

Form W-2, also called the Wage and Tax Statement, is a crucial document that employers must provide to both employees and the Internal Revenue Service (IRS) annually. This document outlines an employee’s yearly earnings and the taxes deducted from their pay. In this guide, we’ll walk you through who needs to file W-2 forms, the information it includes, and the significance of this process.

Who Can File W2 Forms?

Employers must issue a W-2 form to every employee who receives salary, wages, or compensation during the year. It’s important to note that this requirement excludes contracted or self-employed individuals, who use different tax forms. The W-2 must reach the employee by January 31 each year, providing sufficient time for them to complete their income tax filings before the deadline. Employers also utilize W-2 forms to report Federal Insurance Contributions Act taxes for their employees throughout the year. By the end of January, employers must file Form W-2, alongside Form W-3, for each employee with the Social Security Administration (SSA). The SSA utilizes this data to calculate Social Security benefits for each worker.

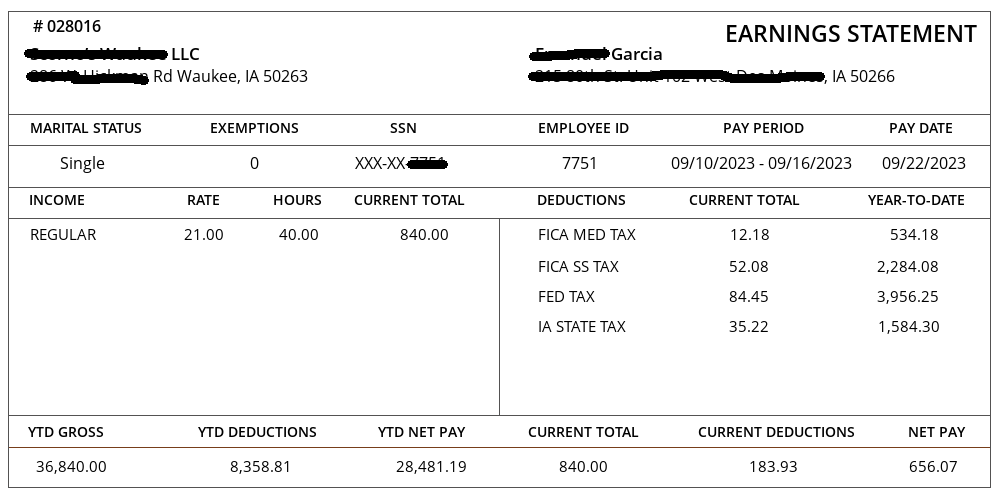

What Information Does Form W-2 Include?

W-2 forms include consistent fields, regardless of the employer. They are categorized into state and federal sections, as employees are required to file taxes at both levels. The form includes the employer’s details, such as the federal Employer Identification Number (EIN) and state ID number. Other fields detail the employee’s income from the previous year, covering total earnings, tax withholdings (for federal income tax, Social Security tax, etc.), and, if applicable, tips earned. If an individual has multiple jobs issuing W-2s, each job’s information must be input separately. Try paystub creator.

Filing Taxes with Form W-2: Wage and Tax Statement

When filing taxes, the amount of tax withheld according to the W-2 form is subtracted from the gross tax obligation. If excess tax was withheld, a refund is issued. The IRS uses Form W-2 to monitor an employee’s income and tax liability. If discrepancies arise between reported income on taxes and the W-2, the IRS may conduct an audit. Taxpayers must report all salary, wage, and tip income, even if not reported on a W-2.

Can I File W-2 Form Online – Pay-stub.co

Employers are required to provide W-2 copies to eligible employees by the end of January or early February, either by mail or electronically. Pay-stub.co offers a w2 generator for easy online form creation. Users can preview W-2 details before purchase, facilitating secure and convenient management of essential pay information.

Conclusion

Form W-2 is an essential IRS document that employers must send to both employees and the IRS annually. It outlines an employee’s annual wages and tax withholdings, serving as a key component in the annual tax filing process. Utilizing resources like the W-2 generator at Pay-stub.co ensures a secure and straightforward method for managing crucial pay information online.