The W-2 Form: Key Insights for Seamless Filing

Tax filing can be a complicated process, especially when it involves understanding necessary documents like W-2 forms. For both employers and employees, understanding the nuances of this important document is paramount to a smooth tax filing experience. In this article, we’ll delve into the key things you need to know while filing the W-2 form.

1. What Is the W-2 Form and Why Is It Important?

The W-2 form, officially known as the Wage and Tax Statement, is a mandatory document provided by employers to employees. This form outlines an employee’s annual earnings and the taxes withheld throughout the year. It is a critical component for both employees and the Internal Revenue Service (IRS) during the tax filing season.(Source:pay stub generator)

2. Who Receives a W-2 Form?

If you are an employee who earned $600 or more during the tax year, including non-cash payments, your employer is required to furnish you with a W-2 form. This form is essential for individuals from whom any income, Social Security, or Medicare tax has been deducted.

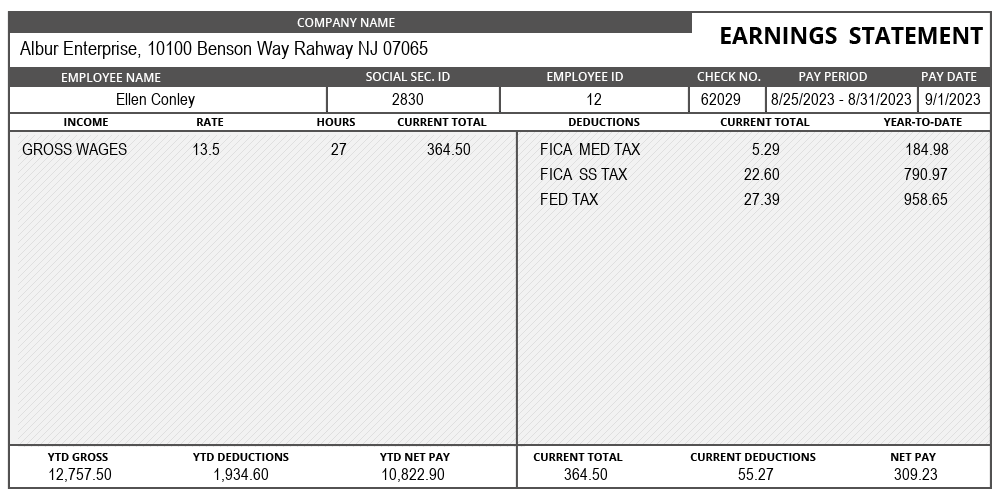

3. What Information Does the W-2 Form Contain?

The W-2 form is a comprehensive document that includes various pieces of information:

Box 1: Wages, tips, and other compensation.

Box 2: Federal income tax withheld.

Box 3: Social Security wages.

Box 4: Social Security tax withheld.

Box 5: Medicare wages and tips.

Box 6: Medicare tax withheld.

Boxes 7-10: Additional compensation and tax-related information.

4. Distribution of W-2 Forms by Employers

Employers are required to provide employees with their W-2 forms by January 31st of each year. This deadline ensures that employees have sufficient time to prepare and file their tax returns before the April 15th deadline.

5. Importance of Correct Employee Information

Employers must ensure the accuracy of the information provided on the W-2 form. This includes verifying employee names, Social Security numbers, and addresses. Any discrepancies should be rectified promptly to avoid potential issues during the tax filing process.

6. Tax Withholding and Employee Contributions

The W-2 form details the various taxes withheld from an employee’s earnings, including federal income tax, Social Security tax, and Medicare tax. Additionally, it may reflect employee contributions to retirement plans, health savings accounts, and other benefits.

7. Health Coverage Information

The W-2 form may include information regarding employer-sponsored health coverage. This is not for tax purposes but serves as information for employees.

8. Reporting Additional Income

Apart from regular wages, the W-2 form may include additional income such as bonuses, commissions, or other forms of compensation. Employers must accurately report all forms of income in the respective boxes on the W-2 form.

9. Understanding State-Specific Requirements

In addition to federal requirements, some states have their own filing requirements and forms. Employers operating in multiple states or employees residing in different states should be aware of and adhere to state-specific guidelines.

11. Retaining W-2 Forms for Record-Keeping

Both employers and employees should retain copies of W-2 forms for a specified period. Employers are advised to keep copies for at least four years, while employees are recommended to keep them for at least three years. These documents may be required for audits or reference in the future.

12. Correcting Errors on W-2 Forms

If errors are identified on the W-2 form, employers should promptly issue corrected forms to employees. The corrected forms, known as W-2c, should be submitted to the Social Security Administration to rectify any inaccuracies.

Conclusion

Navigating the intricacies of the W-2 form is essential for both employers and employees. By understanding the key components, deadlines, and electronic filing options, individuals can ensure a seamless tax filing process. As tax regulations may evolve, staying informed and seeking professional guidance when needed will contribute to accurate and compliant W-2 filings.Use W-2 generator at pay-stub.co. Preview W-2 form details before making purchases – enabling secure and intuitive management of critical payment information online.