The Crucial Role of Check Stubs in Tax Payments

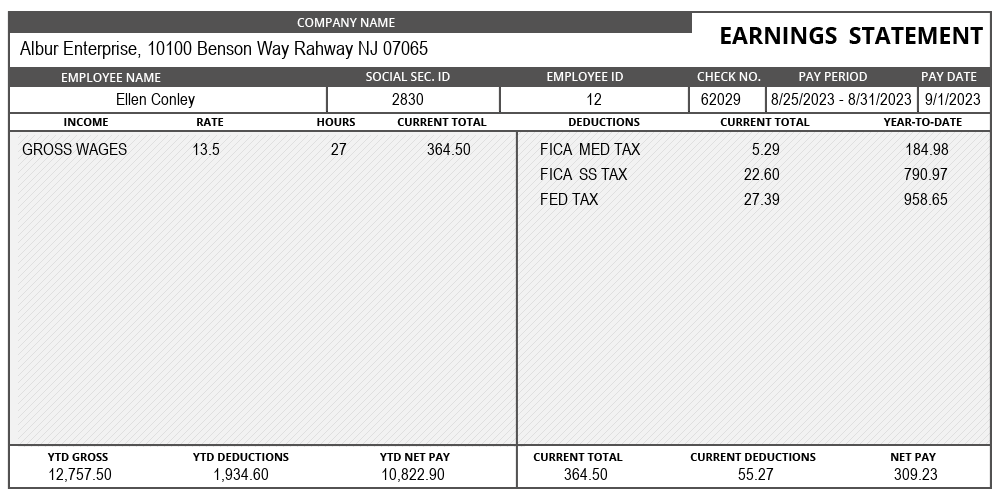

Check stubs, also known as pay stubs or paycheck stubs, play a vital role in the process of tax payments for both employees and employers. These documents provide a detailed breakdown of earnings, deductions, and withholdings, serving as essential tools during tax preparation and ensuring compliance with tax regulations. In this article, we explore the significant role that check stubs play in facilitating the tax payment process.

1. Income Documentation

A sample pay stub serves as comprehensive income documentation, providing a detailed record of an individual’s earnings. This information is crucial when individuals file their income tax returns, as it accurately reflects their total income for the tax year.

2. Tax Withholdings

One of the key components of check stubs is the breakdown of tax withholdings. Employees can review their check stubs to ensure that the correct amount of taxes is being withheld from their paychecks, helping them avoid underpayment penalties and ensuring compliance with tax laws.

3. Deductions and Credits

Check stubs provide valuable information about various deductions and credits that may apply to an individual’s tax situation. This information is essential for individuals seeking to maximize their eligible deductions and credits when filing taxes.

4. Verification of Taxable Income

When individuals receive their W-2 forms, which summarize their annual earnings and tax withholdings, the information is derived from their check stubs. Employers use the year’s worth of check stubs to compile accurate W-2 forms, providing a detailed breakdown of taxable income for employees.

5. Self-Employed Individuals

For self-employed individuals, check stubs or income statements serve as critical documentation for tax purposes. They provide a detailed record of income earned, business expenses, and other financial details that are necessary for accurately reporting self-employment income on tax returns.

6. Tax Planning

Throughout the year, individuals can use their check stubs for tax planning purposes. By regularly reviewing their earnings, withholdings, and deductions, they can assess their tax liability and make adjustments as needed. This proactive approach helps individuals avoid surprises during tax season and ensures better financial planning.

7. Employer Tax Reporting

Employers play a crucial role in tax reporting, and check stubs are the foundation of accurate and compliant employer tax reporting. Employers use the information from check stubs to prepare and submit required payroll tax forms, such as W-2s, to both employees and relevant tax authorities.(Source-w2 generator)

In conclusion, check stubs are invaluable tools in the tax payment process, serving as a detailed record of income, deductions, and withholdings. For employees, they provide transparency and empower individuals to stay informed about their financial situation. For employers, check stubs are essential for accurate tax reporting and compliance. As tax regulations evolve, leveraging the information contained in check stubs becomes increasingly critical for both individuals and businesses, contributing to a smoother and more transparent tax payment process.