What Information is Included in a Pay Stub for a Self-Employed Individual?

The creation of a pay stub for a self-employed individual involves including a variety of crucial information. These details not only serve as a record of earnings but also contribute to establishing the legitimacy of income for various financial and legal purposes. Below is a breakdown of the essential information that is included in a pay stub for a self-employed individual:

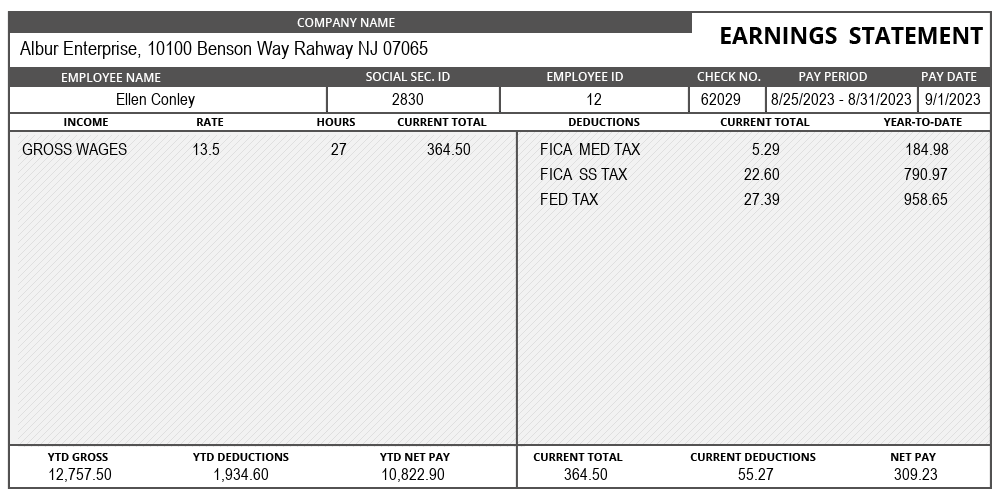

Name and Address

The basic personal details of the self-employed individual, including their full name and current address, are fundamental components. These serve as the primary identifier, establishing the connection between the pay stub and the individual who owns it.

Business Name and Business Address

The inclusion of the self-employed individual’s business name and its corresponding address is crucial. This information serves as evidence that the individual operates a legitimate business and has a source of income. Lenders and other entities often require this data to verify the legitimacy of earnings.

Payment Date

The date on which the payment is made must be mentioned on the pay stub. This information is essential for tracking when the funds were released, providing a reference point for the specific pay period covered by the pay stub.

Pay Period

One of the critical details on a self employed pay stub is the pay period, specifying the date range for which the payment is made. This information ensures accuracy in determining the amount earned during a specific timeframe, considering factors such as duration and rate.

Payment Amount

The pay stub is incomplete without the inclusion of the payment amount. This figure represents the total earnings of the self-employed individual for the specified pay period. It is a fundamental aspect of tracking income and financial planning.

Expenses

Business expenses that are reimbursed during the pay period should be clearly outlined. This section helps in calculating deductions from the total income, providing a comprehensive view of the net earnings after accounting for business-related costs.

Net Pay

The net pay represents the total amount the self-employed individual is set to receive after deducting business expenses. This figure is significant as it indicates the actual funds available for both business and personal expenses, offering a clear picture of disposable income.

Year-to-Date Information

Including year-to-date details is essential for providing a comprehensive overview of the self-employed individual’s earnings and deductions throughout the year. This information aids in financial planning, taxation, and maintaining accurate financial records. (Source:sample pay stub)

Other Information

Depending on specific circumstances, self-employed individuals may include additional details on the pay stub. For instance, if there is an ongoing debt with another company, the pay stub can document the payment to be made on a specific pay period, offering transparency and clarity.

Conclusion

Pay stubs for self-employed individuals are essential tools for managing finances and providing proof of income. Generating accurate pay stubs can be easily accomplished using online paystub generator, ensuring transparency and ease for self-employed professionals. With Pay-Stub.co, self-employed individuals can instantly create and preview detailed pay stubs, ensuring transparency and efficiency in documenting their earnings.