Navigating IRS Forms W-2 and W-4: A Comprehensive Guide

The Internal Revenue Service (IRS) requires two forms, W-2 and W-4, to manage tax withholding from employees’ paychecks. Form W-4 is completed by employees when they start a new job, and it helps employers withhold the appropriate amount of taxes from their pay. At the end of the year, employers submit Form W-2 to the IRS, which reports the total amount of taxes withheld from each employee’s paycheck. Both forms are essential for determining the total taxes withheld and whether employees are eligible for a tax refund. The IRS and employees rely on Form W-2 to finalize their tax returns.

W-4 Form: Employee’s Withholding Certificate

The W-4 form, also known as the Employee’s Withholding Certificate, is completed by employees to inform their employers about the amount of federal income tax to withhold from their paychecks. When a new employee joins a company, they are required to fill out a W-4 form within the first month of employment. This form includes crucial details such as the employee’s number of dependents, marital status, and other factors that impact tax withholding.

It’s important to note that employees can update their W-4 forms anytime their financial situation changes, requiring more or less withholding from each paycheck. This ensures that the correct amount of taxes is withheld based on the individual’s circumstances.

W-2 Form: Wage and Tax Statement

The W-2 form, known as the Wage and Tax Statement, is filled out by employers at the end of each year. Employers are required to send the IRS a W-2 form for each employee, providing a comprehensive summary of the employee’s earnings and tax withholdings throughout the year. Additionally, employers must furnish employees with their W-2 forms by January 31 of the following year.

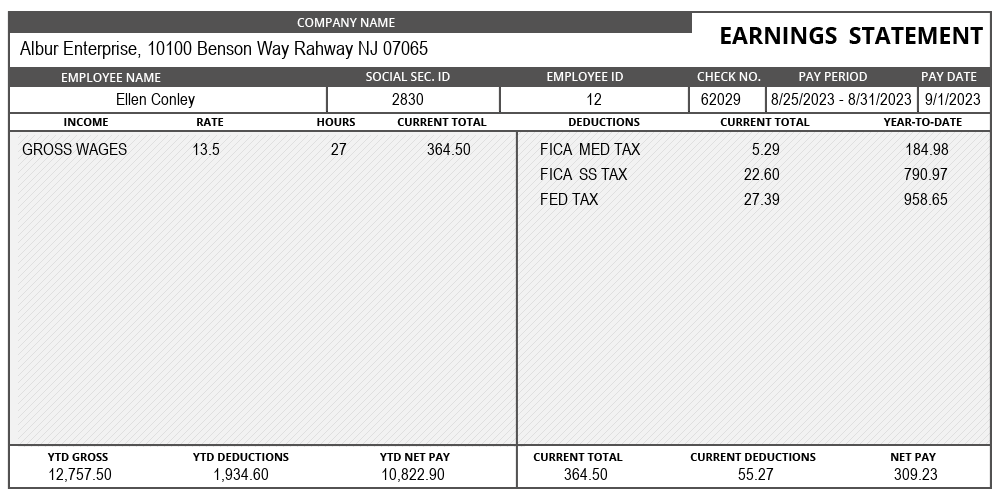

The W-2 form includes various details such as gross pay, tips, bonuses, federal tax withheld, and Social Security and Medicare taxes. It also reflects any additional deductions, such as contributions to retirement plans, giving employees a comprehensive overview of their financial transactions with the company. (Source: check stubs)

Submitting the Forms

New employees typically submit the W-4 form when they start a new position. However, it should be updated whenever there are changes in their financial situation. Employers, on the other hand, must file the W-2 form every year. To meet reporting deadlines, employers must submit W-2 forms to both employees and the IRS by January 31 of the following year.

Tips for Entrepreneurs: Completing W-2 and W-4 Forms with Ease

Completing W-2 and W-4 forms accurately and on time is crucial for both employers and employees. Here are some guidelines to streamline the process, particularly for small businesses:

Be Proactive and Quick: Fill out these forms well in advance to avoid late penalties. For W-2s, start working on them as soon as the new year begins to meet the January 31 deadline.

Hire an Accountant: Consult a business accountant or tax advisor for assistance, especially if the forms seem complex. Professional guidance can make the process more efficient and error-free.

Consider Filing Electronically: The IRS recommends filing W-2 forms electronically for convenience and environmental sustainability. Storing W-4 forms electronically also allows for quick access and organization.

Invest in Payroll Software: Use payroll software with W-4 and W-2 features to simplify the process. This allows employees to fill out forms on the platform, streamlining the filing process.

Exercise Caution: Mistakes on W-2 and W-4 forms can have serious consequences. Take the time to ensure accuracy, preventing unexpected issues for your company in the future.

Conclusion

Understanding the nuances of W-2 and W-4 forms is essential for both employers and employees to navigate tax obligations accurately. Following these guidelines can help streamline the process, ensuring compliance with IRS regulations and avoiding potential pitfalls during tax season. Explore tools like the w2 generator at Pay-stub.co for secure and easy management of vital pay information online.